florida boat trailer sales tax

Six 6 percent sales tax must be paid on all recreational vehicles RVs sold andor delivered in Florida unless specifically exempted by law. On Florida vessel titles notarization is NO longer required.

2004 Shoreline Marine By Performance Trailers Aluminum Boat Trailer M Aal 20 22t Tandem Axle Ove Vehicles Marine Aviation Boats Boat Trailers Online Auctions Proxibid

All new owners must be present to sign the title application form and must present legal ID.

. Similarly in Florida a non-resident need not pay tax if the boat. If you are looking into a superyacht purchase the cap for sales tax in Florida is 1800000. Travel Trailer 35 ft or less tag fee 3860.

A 90 Day Decal May Be Purchased From Your. If the trailer is bought used you will need to bring sellers registration and you will need a bill of sale. Additional fee of 1 to record each existing lien.

This includes both sales and use tax and discretionary sales surtax. Occasional and isolated sales of vessels between persons who are not boat dealers. If purchased in Florida bring in bill of sale to obtain tag plate decal For homemade trailers obtain a certified weight slip can obtain from the Rosemary Landfill to obtain a tag and receipts for materials purchased Private Use 500 lbs tag fee 1835.

Generally Florida boat dealers and yacht brokers must collect sales tax from the purchaser at the time of sale or delivery. This is because the outboard engine is not. Well explain all you need to know about Florida sales tax and outboard engines.

A boat trailer 2000 lbs. Do you pay taxes on trailers in Florida. Use tax applies to taxable goods and services that are brought into the state untaxed or taxed at a rate less than Floridas sales tax rate.

In Florida boat trailers for motorized vessels must be registered. Those prices range from 05-15 but cap at 5000. The maximum tax of 18000 will apply.

Trailers weighing under 2000 pounds are not titled. This figure includes all sales and use tax plus discretionary sales surtax. For estimated costs to title a vessel please call 941743-1350.

Or more must have. Thanks to the efforts of the International Yacht Brokers Association formerly FYBA the maximum tax on the sale of a vessel is 18000. New 2022 Magic Tilt Boat Trailers.

In Maryland for example one need not pay sales tax on a boat that files a certification stating that it is going to leave the state within 30 days of purchase. FLORIDA TAXES State SalesUse Tax 6 Discretionary SalesUse Tax 0 - 75 Depending on County NOW CAPPED AT 1800000 Per Boat Property Taxes on Boats None Florida Issues Titles on Boats that are Not Documented Documented Boats Are Required to be Registered CRUISE FLORIDA TAX FREE FOR 180 DAYS. Florida Department of Revenue Sales and Use Tax on Boats Information for Owners and Purchasers Page 2 Example.

New owners have 30 days to transfer the title or they will be subject to a 1000 delinquent fee. If sales tax has been paid to a Florida dealer or retailer proof of sales tax paid is required and must include the sales tax registration number of the collector Registration fees are based upon vessel length. So for example if your bill of sale reflects 250000 but 75000 is separately itemize for the two 250 horsepower outboard engines on the boat then the DMV is not going to charge you sales tax on the outboard engines.

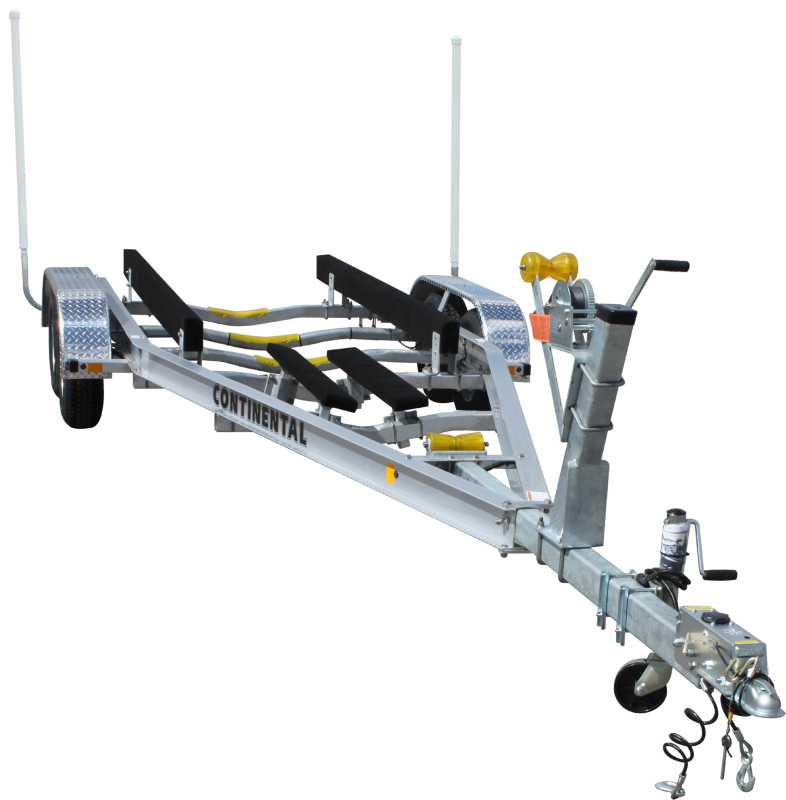

This limit was set back in 2010 and has proved to be very advantageous for both the state and yacht owners. Another very good option to avoid initial sales tax is to identify an escape clause in your local tax jurisdiction. New 2022 Continental Trailers Boat Trailers.

All boat sales and deliveries in this state are subject to Floridas 6 percent sales and use tax unless exempt. All vessel purchasestransfers are subject to FL sales tax 6 plus county discretionary sales tax unless a specific exemption applies. 561-799-6511 Monday Friday 830 AM 5 PM.

Many counties also impose a local discretionary sales surtax which applies to the first 5000 of. Xpress Series Tandem Axle Alum TXP2044B2. Types of motor vehicle transfers see Sales Tax on Automobile Transfers beginning on page 16 of this tax guide.

The absolute maximum tax you can pay on the sale of a boat or vessel in the state of Florida is 18000 as of 2018 state tax rates. Florida sales tax law is a confusing topic for boat buyers. Or more must also be titled.

Boats purchased from an individual should be taxed on the hull only if the hull is itemized on the invoicebill of sale. Depending on which county the boat is delivered to Discretionary Taxes come into play. The following fees are assessed when applying for a Florida Certificate of Title in addition to registration fees and any applicable sales tax.

A boat trailer that is 2000 lbs. 67-6-1028C Boat Sales Similarly sales of boats are sales of tangible personal property subject to sales or use tax. 525 titling fee for electronic title or 775 for paper title or 11 expedited fast title.

A credit is allowed for taxes paid to another state the. Use Tax Use tax is a component of Floridas sales and use tax. A A A -Tropic Trailer Sales - Website.

If the trailer is over 2000 pounds call the Florida Division of Motorist Services at 8504755415 to arrange for an appointment and upon inspection a Compliance Examiner will assign and affix a Trailer Identification Number. If you purchase a boat in a state that has a sales tax rate of 4 you must pay an additional 2 when you bring the boat into Florida plus any applicable discretionary sales surtax. Discretionary sales surtax is also due on the first 5000 of these purchases.

So you as the buyer will only pay sales tax on the boat itself to the DMV. Maximum Tax The maximum tax on the sale of a boat or vessel is 18000. Some might be a little more and others a little less but Florida has a flat sales tax rate of 6.

The maximum tax on the repair of a boat or vessel is 60000. However if you purchase a used boat from an individual even if on consignment through a dealer and the itemized invoiceBOS includes other items outboard trailer etc then the FL tax collectors agent will likely. For sales tax purposes a boat dealer and yacht broker are the same.

Sales tax if applicable registration fees. The owner of a boat trailer should title and register the trailer within 30 days. If the trailer is bought brand new you will need to bring a manufactures statement of origin bill of sale or invoice from the seller and taxes will be collected if applicable.

Continental Trailers Jb1512 Galvanized Bass Jon Boat Trailer Advantage Trailer Company New Used Trailers For Sale Flatbed Dump Car And Cargo Trailers In St Petersburg Fl

Stock D886r Used 1987 Ranger Boat Trailer Bedford Virginia 24523 East Coast Auto Source Inc

2021 Tuff Trailer Tsa8500 Aluminum Boat Trailer All Parts Trailer Sales Offering Dump Equipment Boat Enclosed Utility Trailers For Sale In Bc Find Trailer Service Parts And Financing In Abbotsford

Continental Trailers A1840b Drive On Boat Trailer Advantage Trailer Company New Used Trailers For Sale Flatbed Dump Car And Cargo Trailers In St Petersburg Fl

New 2022 Shoreland R Premium Tandem Axle Trailer For 17 5 20 Boat Boat Trailers In Spearfish Sd Stock Number Sho

2021 Tuff Tsa2500ts 15 18 Aluminum Boat Trailer All Parts Trailer Sales Offering Dump Equipment Boat Enclosed Utility Trailers For Sale In Bc Find Trailer Service Parts And Financing In Abbotsford

2021 Tuff Trailer Tsa4000tl Aluminum Boat Trailer All Parts Trailer Sales Offering Dump Equipment Boat Enclosed Utility Trailers For Sale In Bc Find Trailer Service Parts And Financing In Abbotsford

Boat On A Trailer By The Sea Boat Boat Storage New Pontoon Boats

2022 Venture Aluminum Tandem Axle Vatb 5225 Boat Trailer All Parts Trailer Sales Offering Dump Equipment Boat Enclosed Utility Trailers For Sale In Bc Find Trailer Service Parts And Financing In